2.7 (Micro) Calculating the effects of indirect taxes on stakeholders & welfare: IB Econ

2.5, 2.6, 2.7 (Micro) Excise tax, Indirect tax: Calculate PED & PES: Cigarettes NY State: Pt. 5Подробнее

2.7 (Micro) Excise tax, Indirect tax: Calculate Welfare, Gov't Revenue: Cigarettes NY State: Pt. 4Подробнее

2.7 (Micro) Calculating the effects of indirect taxes on stakeholders & welfare: IB EconПодробнее

2.7 (Micro) Calculating the effects of price ceilings on stakeholders & welfare: Price controlsПодробнее

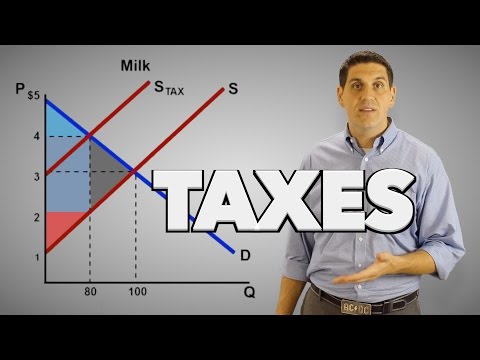

Taxes on Producers- Micro Topic 2.8Подробнее

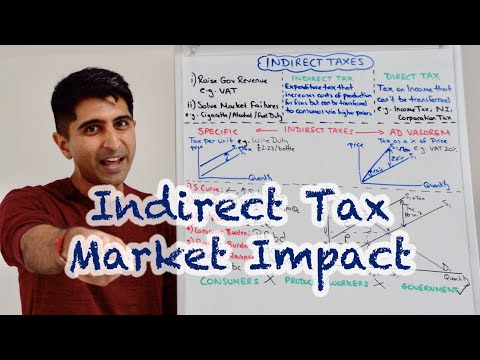

Y1 16) Indirect Tax - Full Market ImpactПодробнее

2.7 (Micro) Calculating the effects of a per unit subsidy on stakeholders & welfare: IB EconПодробнее

Indirect Taxes - Government Intervention & Stakeholders | Economics RevisionПодробнее

Government Intervention- Micro Topic 2.8Подробнее

Calculating effects of indirect taxes (HL Only)Подробнее

Y1 17) Indirect Tax and Elasticity (Consumer, Producer and Government Evaluation)Подробнее

IB ECONOMICS : Indirect Tax - Graphical & Stakeholder AnalysisПодробнее

Indirect Taxes and PED | 60 Second Economics | A-Level & IBПодробнее

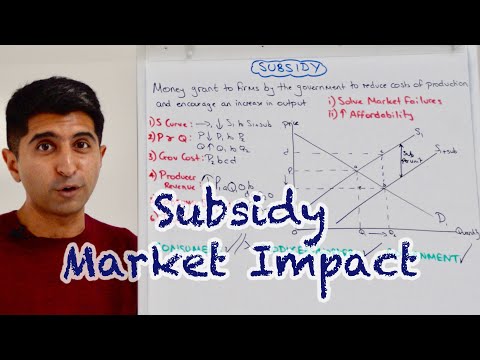

Y1 18) Subsidy - Full Market ImpactПодробнее

2.7 (Micro) Calculating the effects of price floors on stakeholders & welfare: Price controlsПодробнее

IB economics - indirect taxesПодробнее

Micro Unit 6, Question 12- Tax Incidence (Excise Tax)Подробнее

Indirect Taxes and Consumer Surplus I A Level and IB EconomicsПодробнее

2.7 (Micro) Tax incidence (tax burden) & PED & PES: Cigarettes: Inelastic PED: IB Econ: Part 1 of 2Подробнее

7.11 The Welfare Effect of a TaxПодробнее