You Have Missed Filing Your Income-Tax Return | Kindly File and e-Verify Your ITR on e-Filing Portal

Income Tax Return Filing Error | ITR Filing Problem Solve | ITR Filing process Problem | #itrerrorПодробнее

itr 1 filing online 2025-26 | ITR filing under old tax regime | Income tax return online 2025-26Подробнее

File your Income-Tax Return for A.Y. 2024-25 Today | Higher TDS deducted but Income-Tax Return notПодробнее

E Verify Your ITR without Aadhaar OTP, DSC, Internet Banking | How to E Verify Income Tax ReturnПодробнее

Income Tax Return (ITR) e Verify kaise kare | ITR e verification with Aadhaar | e-Verify ITR onlineПодробнее

Restricted Refund in Bank account prevalidate for income tax return 2025-26 e filing portal SolutionПодробнее

File Salary ITR in 10 mins | CA Rachana RanadeПодробнее

Income tax paid but still showing amount payable in ITR 2025 | Tax Payment challan download onlineПодробнее

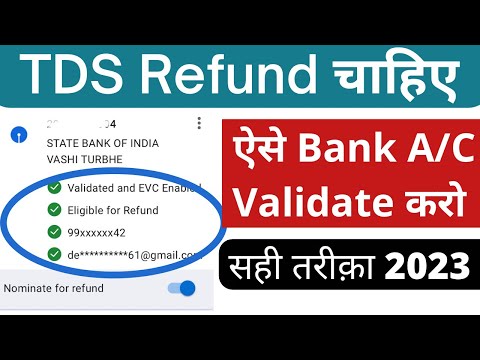

How to Pre Validate,add bank account in income tax e filing portal in 2023-24 for Income tax refundПодробнее

Forget to E-verify ITR within time limit, apply condonation II E-Verify ITR after time lapse IIПодробнее

Tax Filing in less than 5 mins (TAMIL) - Income tax return filing 2022-23Подробнее