VaR (Value at Risk) and CVaR (Conditional Value at Risk) Explained in Graphics

Value-at-Risk (VaR) Dashboard using Streamlit (CAViaR Model by Engle and Manganelli, 2004)Подробнее

Skule Lunch & Learn: Risk-Aware Control Theory for Sustainable Cities and HealthcareПодробнее

Conditional Value-at-Risk - Nathan BenedettoПодробнее

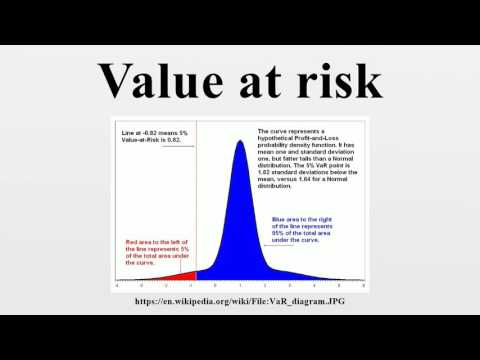

Value at Risk (VaR) Explained in 5 minutesПодробнее

Subhonmesh Bose: Risk-Sensitive Market Design for the Power GridПодробнее

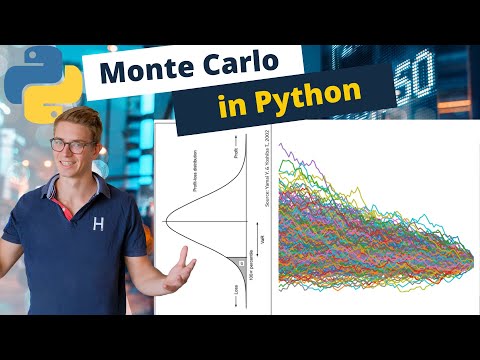

Monte Carlo Simulation with value at risk (VaR) and conditional value at risk (CVaR) in PythonПодробнее

Risk and Robustness in Reinforcement Learning by Shie MannorПодробнее

Parametric VaR and CVaR with PythonПодробнее

Value at Risk (VaR) Explained!Подробнее

Conditional Value at Risk and Stress Testing in Financial Risk ManagementПодробнее

Credit Value at Risk for a portfolio using SimulationПодробнее

Value at riskПодробнее