Maximize Your Finances as a High W2 Income Earner

Maxing Out Your Retirement Account For High Income Earners (Wealth Lawyer Explains)Подробнее

Reduce Your W2 Taxable Income in 2024: Proven Strategies for SavingsПодробнее

Maximize Your Tax Savings - Strategies for Medical Professionals!Подробнее

15 Biggest Money Mistakes High Income Earners Make (And How To Avoid Them)Подробнее

Top Tax Strategies for High-Income W-2 Employees!Подробнее

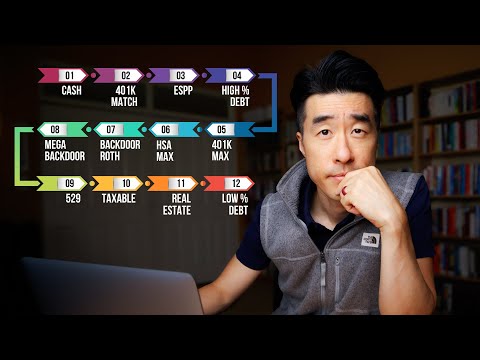

The MOST OPTIMAL Order of Investing for High-Income Earner |401K, Roth IRA, Mega Backdoor InvestingПодробнее

Ideal Order Of Investing For High Income EarnersПодробнее

These 7 Investments Will Reduce Your Taxes ImmediatelyПодробнее

The Top 5 Ways to Reduce Taxes on W2 & Active IncomeПодробнее

Maximize Your Money Unveiling Game-Changing Tax Strategies for W2 EarnersПодробнее

How High Income Earners Should Buy Real Estate: Stop Paying Taxes!Подробнее

W2 Employees: #1 Way to Pay Less Taxes (STR Loophole)Подробнее

Tax Saving Strategies for High Income Individuals in 2024Подробнее

Mandatory Roth Catch-up Contributions for High Wage Earners – Secure Act 2.0Подробнее

5 FAFSA Tips That Will Reduce Your EFCПодробнее

Should You Use a Roth 401(k) If You Have a High Income?Подробнее

Get An LLC To Avoid Paying High Taxes?Подробнее

How Big Earners Reduce their Taxes to ZeroПодробнее

Tax Strategies for High Income Earners to Help Reduce TaxesПодробнее