CFA Level II: Portfolio Management- Analysis of Active Portfolio Management Part I(of 2)

Portfolio Management Pathway - CRS - Jerry Lawson - CFA® Level IIIПодробнее

CFA level 1 Portfolio Management RevisionПодробнее

CFA L2 Portfolio Management | Analysis of Active Portfolio Management Core Questions PracticeПодробнее

CFA® Level II Portfolio Management - Active Management & Analysis of Active ReturnsПодробнее

CFA Level II - The Hardest to Easiest Topics (as a Level III Candidate)Подробнее

Portfolio Performance Evaluation – Part II (2025 Level III CFA® Program – Reading 25)Подробнее

Trade Strategy and Execution – Part I (2025 Level III CFA® Program – Reading 24)Подробнее

Risk Management for Individuals – Part II (2024 Level III CFA® Program – Reading 22)Подробнее

Asset Allocation to Alternative Investments – Part I (2025 Level III CFA® – Reading 19)Подробнее

Overview of Equity Portfolio Management (2025 Level III CFA® – Reading 14)Подробнее

Liability-Driven and Index-Based Strategies – Part II (2025 Level III CFA® – Reading 11)Подробнее

Overview of Fixed-Income Portfolio Management (2025 Level III CFA® Exam – Reading 10)Подробнее

Portfolio Rebalancing in Portfolio Management (Part 1) - CA/CMA Final SFMПодробнее

Portfolio Risk and Return – Part II (2025 Level I CFA® Exam – PM – Module 2)Подробнее

Portfolio Management: An Overview (2025 Level I CFA® Exam – PM – Module 1)Подробнее

Using Multifactor Models (2025 Level II CFA® Exam – PM–Module 2)Подробнее

Exchange-Traded Funds: Mechanics and Applications (2025 Level II CFA® Exam – PM–Module 1)Подробнее

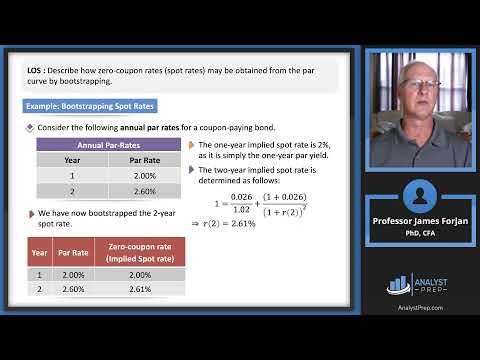

The Term Structure and Interest Rate Dynamics (2025 Level II CFA® Exam –Fixed Income–Module 1)Подробнее

Portfolio Risk and Return: Part II - CFA Reading 40 Level 1Подробнее

CFA Level 3 - Overview of Equity Portfolio Management Part 1 (Reading 22)Подробнее