18. Capital Budgeting - NPV( Net Present Value ) Practical Problem Most Important from FM Subject

19. Capital Budgeting - IRR Internal Rate Of Return - Practical Problem -Most Important from FM SubПодробнее

19. IRR (Internal Rate Of Return) Practical Problem Most Imp from Capital Budgeting - FM SubjectПодробнее

18. NPV (Net Present Value) Practical Problem from Capital Budgeting - Financial Management SubjectПодробнее

17. NPV (Net Present Value ) Introduction from Capital Budgeting Chapter - Financial Management SubПодробнее

#4 Net Present Value (NPV) - Investment Decision - Financial Management ~ B.COM / BBA / CMAПодробнее

Capital Budgeting: NPV, IRR, Payback | MUST-KNOW for Finance RolesПодробнее

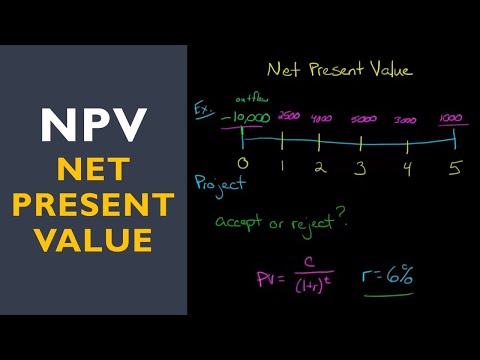

How to calculate the Net Present value (NPV)Подробнее

Net Present Value (NPV)Подробнее

Capital budgeting (part - 18) practical Ques'n 👉 Q 14 (A)Подробнее

Capital Budgeting Techniques in English - NPV, IRR , Payback Period and PI, accountingПодробнее

Net Present Value calculation | NPV Formula | NPV results | Financial Management | #npv #financeПодробнее

#4 Net present Value Method of capital budgeting | NPV calculation | with Solution | by kauserwise®Подробнее

What is Net Present Value?Подробнее

Introduction to Net Present Value (NPV)Подробнее

Capital Budgeting NPVПодробнее

Capital budgeting, Cost of capital, Net present value, Internal Rate of ReturnПодробнее

Example 3 : Mutually Exclusive Projects & NPV: Capital Budgeting: Corporate FinanceПодробнее

NPV (Net Present Value) - ExcelПодробнее

Example 1 : Pay Back Period : Capital Budgeting: Corporate FinanceПодробнее

Capital budgeting III: NPV vs IRR, modified IRRПодробнее