1099/1042-S Changes, Updates and Insight for Tax Year 2020

What is Form 1042-S? | Understanding IRS Tax Withholding for Foreign PersonsПодробнее

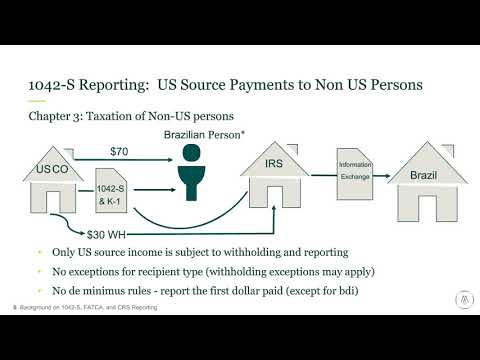

AEOI and 1042-S Reporting in 2020Подробнее

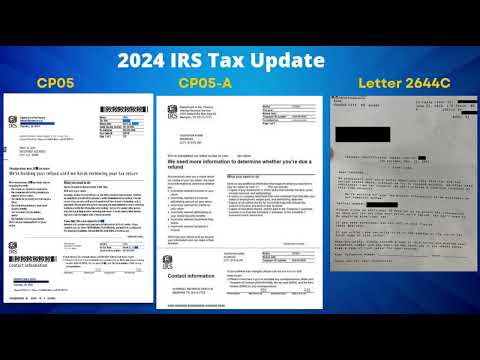

2024 IRS TAX REFUND UPDATE - New Refunds Approved, Delays, Codes 570, 971, Tax Return HoldsПодробнее

Tax Year 2020 W-2 and 1099 FilingПодробнее

2014 Complete 1099, 1042-S and FATCA Year-End Update - GlobalCompliancePanelПодробнее

How to Complete IRS Form 1042-S for Payments to NonresidentsПодробнее

How To File Form 1042-S | File 1042-S ElectronicallyПодробнее

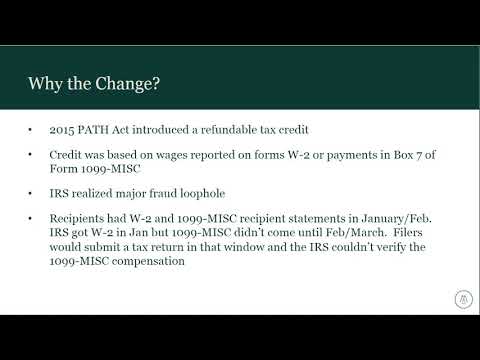

2020 Form 1099 Filing Update for Nonemployee CompensationПодробнее

1099 Tax Deductions Explained (2023)Подробнее

How to file 1099, W-2, and 1042-S corrections with eFileMyFormsПодробнее

Understanding Form 1042-SПодробнее

Important IRS Change to Impact W-2 & 1099 Filing for BusinessesПодробнее

Unlock Immediate Tax Savings: Accelerate Depreciation and Boost Cash Flow with Cost Segregation!Подробнее

A Comprehensive Guide to IRS 1099-R Form for the 2024 Tax YearПодробнее

How To 1099 Someone - How Do I Create, Send, File 1099s for Independent Contractors from my BusinessПодробнее

Owners 1099s and 1042sПодробнее

What is Form 1042?Подробнее

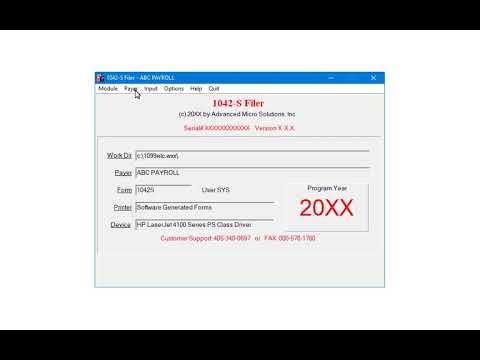

1042-S TutorialПодробнее